Business

Huawei: US move to blacklist firm sets a 'dangerous precedent'

A move by the US to put Chinese telecoms giant Huawei on a trade blacklist "sets a dangerous precedent," the firm's top legal officer said.

Speaking at a press conference, Song Liuping said other companies and industries may be targeted next.

The US recently added Huawei to a list of companies that American firms cannot trade with unless they have a licence.

The trade ban is one part of a multi-faceted confrontation between Washington and Huawei.

"Politicians in the US are using the strength of an entire nation to come after a private company," Huawei's chief legal officer Mr Song said.

He said such a move was unprecedented in history.

"Today it's telecoms and Huawei. Tomorrow it could be your industry, your company, your consumers."

- Trump declares emergency over IT threats

- Google restricts Huawei's use of Android

- The next US-China battleground

Mr Song was speaking to reporters in Shenzhen, outlining steps that Huawei had taken in relation to a lawsuit it filed against the US government in March.

The case relates to restrictions that prevent US federal agencies from using Huawei products.

The company said it has filed a motion for a "summary judgement", asking US courts to speed up the process to "halt illegal action against the company".

"The US government has provided no evidence to show that Huawei is a security threat. There is no gun, no smoke. Only speculation," Mr Song said.

A hearing on the motion has been set for 19 September.

Security fears

In recent months, the US has led other countries in blocking the use of Huawei products over concerns that the Chinese government could use the firm to conduct surveillance.

The company has repeatedly denied claims it poses security risks, and says it is independent from the Chinese government.

Huawei has become a central part of a wider US-China conflict, which has primarily played out through a trade war.

US President Donald Trump has however sought to link the two, saying recently that Huawei could be part of a trade deal between the US and China.

Source: bbc.com

- Read more

-

28/May/2019

COCOBOD closes purchases for 2018/19 main crop season

The Ghana Cocoa Board will on Thursday [May 30, 2019] cease its purchases of cocoa beans for the 2018/19 main crop season.

The decision was contained in a statement by the sector regulator to Citi Business News.

COCOBOD said that it will however allow Licensed Buying Companies (LBCs) to obtain returns from up country centres by extending the date by one more week to Thursday [June 6, 2019].

For this crop season, COCOBOD intends to purchase nine hundred thousand metric tonnes of cocoa beans.

This has been backed by the Board’s annual syndicated loan of 1.3 billion dollars secured from twenty-one banks at an interest rate of 2.5 percent.

This is the second consecutive time that the Ghana COCOBOD has secured 1.3 billion dollars for its purchases since the 1.8 billion dollars secured in the 2016/2017 crop year.

The fluctuating world market prices of cocoa impacted the drop in amount secured for the just ended cocoa season.

But Mr. Aidoo in an earlier interview with Citi Business News said his outfit will not be tempted to increase amount secured despite improvement in crop yield.

“When you syndicate, you collateralize cocoa for whatever amount you take. So when the price of cocoa is going down, you will be giving up more cocoa. Because world market price is continuing to fall, we need to tread cautiously…that is why we always go in for a manageable amount based on research by the Monitoring and Research Department of COCOBOD,” the CEO said.

Source: citinewsroom.com

- Read more

-

28/May/2019

Emirates flight attendant dies after fall from plane in Uganda

A flight attendant who fell from the emergency door of a parked aeroplane in Uganda's Entebbe airport has died, the BBC has learned.

The woman, whose nationality has not been revealed, was rushed to Kisubi hospital 16km (10 miles) away but died soon after, a spokesperson said.

Reports say the Emirates Airline employee was preparing the flight for boarding when the incident happened.

Uganda's aviation authorities say they have launched an investigation.

It said in a statement that the flight attendant "appeared to have opened the emergency door" and unfortunately "fell off an aircraft that had safely landed and parked".

Kisubi hospital's spokesperson Edward Zabonna told the BBC that the crew member had injuries "all over her face and knees".

He said that she had been "unconscious but alive" when she arrived at the hospital on Wednesday evening but died soon after.

News agency AFP quotes a statement from Emirates Airline as saying: "A member of our cabin crew unfortunately fell from an open door while preparing the aircraft for boarding".

The Dubai-based airline promised its "full cooperation" with the investigation.

Source: bbc.com

- Read more

-

16/Mar/2018

The young entrepreneurs trying to help South Africa's townships

Lance Petersen sits in his radio studio and chats into his microphone.

While most DJs of his age let the music do the talking, the 25-year-old very much likes to converse with his listeners.

Lance is the founder and owner of Vibe Radio SA, an internet radio station based in the Cape Town township of Athlone.

Set up in 2011, Vibe is aimed at South Africa's teenagers and young adults.

With listeners across the country, it engages with them on topics ranging from bullying, to HIV/Aids, fashion, and advice on becoming an entrepreneur.

Lance says: "The point of Vibe Radio is to provide a platform that focuses solely on the youth voice, and gives young people the opportunity to say what's on their mind, and be heard."

He adds that the radio station was born from his own frustration at the lack of support given to young people in South Africa, and the failure to make them heard on a national level.

"The scariest realisation I had was that the young didn't have a voice, or were seldom heard," says Lance.

"It was at that realisation that I knew I had to find a way to start my own radio station."

A former TV producer, Lance set up the station using his own savings, and support from a Cape Town-based social enterprise called Reconstructed Living Lab (RLabs).

Vibe now has 16 employees, and makes money from advertising.

With the youth unemployment rate in South Africa standing at 37.5% (for people between the ages of 15 and 34), job opportunities are few and far between for many of Vibe's listeners.

As a result, much of the station's focus is on discussing how young people can best go about launching and running their own businesses.

Lance says the aim is for this always to be done in an interesting and entertaining way, or as he calls it - "edutainment".

So for example, in a recent discussion about becoming a concert promoter, and how the cost of each ticket breaks down, he discussed a tour by teen heartthrob Justin Bieber.

Numerous challenges

Another young entrepreneur from a Cape Town township, Andisiwe Nyavula, says that young people in her community need access to basic business services if they are to create self-sustaining companies. So since 2012 she has taken matters into her own hands.

Ms Nyavula, 25, is the founder of Nzum Nzum, a chain of three business centres cum internet cafes that offer photocopying, printing and faxing, company registration, and web access to those trying to get their start-ups off the ground.

Andisiwe Nyavula offers a range of business services

The prices range from five South African rand (35 cents; 27p) for 30 minutes of internet access, to one rand per page of photocopying, and 80 rand for 10 business cards.

About 3,000 people use the centres per month, which are located in the Cape Town townships of Nyanga, Phillipi and Gugulethu.

But as much as Ms Nyavula tries to make a difference, she admits that there are many challenges facing township entrepreneurs that also need to be addressed, such as the high crime rates, rogue landlords, and unhelpful service providers.

"It took more than three months to install a reliable connection at our new internet cafe," she says. "And if there's a problem it takes more than two weeks to fix it.

"The townships have long been shunned by big businesses."

'Incredible individuals'

The World Bank estimates that more than half of South Africa's 53 million population lives in townships and other informal settlements.

With that many potential customers, South Africa's townships should by rights be looked upon as potential economic hotspots.

But attention tends to focus on the negatives, and little notice is given to the economic success stories hiding within South Africa's sprawling townships.

"There are incredible individuals with amazing ideas and grassroots businesses that they run in the townships," says Craig Dumont, a member of the management team at RLabs.

RLabs, which receives government grants to fund its work, provides would-be township entrepreneurs with training and support.

From its main hub in a Cape Town township, since 2008 it has been an incubator for more than 50 start-up companies, and has seen thousands of entrepreneurs - including Vibe Radio's Lance Petersen - walk through its doors and receive business support.

According to Mr Dumont, not only are township entrepreneurs innovative and determined, their knowledge of local needs gives them an advantage over corporate South Africa.

"Township entrepreneurs have a deep understanding of their environment, the challenges, and their target audience," he says.

'Uplifting people'

Based in the Kayamandi township on the outskirts of the affluent Western Cape town of Stellenbosch, some 50km (30 miles) east of Cape Town, Loyiso Mbete is the type of businessman that Mr Dumont would say deserves more credit.

Mr Mbete, 36, is a beekeeper who owns more than 400 hives and employs three people.

He jokes that demand for his honey and related services - such as fruit pollination - is so high that he struggles to keep up.

"I came from a poor family so there was always a need to make it in life," says Mr Mbete. "I had no choice but to find ways and means to make ends meet."

He adds: "It is important to understand that those businesses active in township are feeding the poor and uplifting people out of poverty. They also help create employment, so they are making a big contribution to the South African economy."

While many businesses in South Africa's townships complain that they don't get enough help from the authorities, the Western Cape Government says that in recent years it has greatly increased the support on offer.

Alan Winde, its Minister for Economic Opportunities, says that over the past two years more than 2,000 small businesses based in townships across the province have been assisted by a scheme called the emerging business support programme. This provides financial management, sales and marketing training.

He adds: "Regions across the province, including townships, are vibrant spaces for innovative small businesses."

Source: bbc.com

- Read more

-

04/Aug/2016

Ex-airport boss admits to US holiday scam

A former New Jersey airport official has pleaded guilty to using his position to get a weekly direct flight to his holiday home.

David Samson, a mentor to New Jersey Governor Chris Christie, could be sentenced to up to two years in prison.

United Airlines ended the money-losing route from Newark, New Jersey, to Columbia, South Carolina, three days after Samson resigned.

United CEO Jeff Smisek quit after an investigation into the route.

Mr Smisek has not been charged with any criminal wrongdoing.

Samson was the chairman of the Port Authority of New York and New Jersey, which oversees New York City-area airports.

United Airlines ended the money-losing route after Samson stepped down

At the time the route operated, United Airlines was lobbying for improvements at Newark Liberty International Airport, which the Port Authority owns.

Samson told prosecutors that he used the "chairman's flight"' 27 times between October 2011 and January 2014.

He owned a vacation home in Aiken, about 60 miles (96km) south west of Columbia.

After Samson pleaded guilty on Thursday, federal prosecutors also charged Jamie Fox, a former lobbyist for United in the scheme.

Governor Christie named Mr Fox as New Jersey's transportation commissioner in 2014. He resigned in October 2015.

Source: bbc.com

- Read more

-

14/Jul/2016

Ex-European Commission head Barroso under fire over Goldman Sachs job

France has called on the former head of the European Commission, Jose Manuel Barroso, not to take up a job advising US bank Goldman Sachs on Brexit.

French Europe Minister Harlem Desir called the move "scandalous" and said it raised questions about the EU's conflict of interest rules.

Ex-commissioners are free to take up a new role 18 months after leaving.

Despite accepting the job after 20 months, Mr Barroso has come under fire for ignoring the spirit of the rules.

Mr Desir drew attention to the ill-timing of the job with Goldman Sachs.

"It's a mistake on the part of Mr Barroso and the worst disservice that a former Commission president could do to the European project at a moment in history when it needs to be supported and strengthened," he told the French parliament, referring to Europe's shock after Britain voted to leave the EU on 23 June.

The bank hired Mr Barroso as an adviser and non-executive chairman of its international business, with a brief of advising the bank on the consequences of Brexit.

Mr Barroso has said he hopes to bring his EU experience to bear as the bank's London operation deals with Britain's imminent negotiation of withdrawal from the EU.

In his new role, Mr Barroso will be able to draw on his intimate knowledge of the EU and have access to many officials and politicians he worked with at the European Commission.

'It doesn't surprise me'

Mr Desir's attack in the French parliament was the latest in a sustained tirade against Mr Barroso's appointment, with some calling it "shameful".

French Finance Minister Michel Sapin told reporters on Tuesday "If you have loved Europe, you shouldn't do this to it, especially not now," adding: "But this doesn't surprise me from Mr Barroso."

Who is Jose Manuel Barroso?

- Conservative ex-premier of Portugal

- President of the European Commission, the EU's executive arm, from 2004-2014

- As Commission head he was at heart of the banking crisis and the fallout within the Eurozone

- Has said in the past Britain could not negotiate with the US and China "on an equal footing" on its own

The European Ombudsman has called for the EU to tighten rules on commissioners taking appointments after leaving office.

Ombudsman Emily O'Reilly said adhering to technical rules did not absolve former staff of a wider duty to show integrity.

"Any suggestion that the spirit of the law is being ignored risks undermining public trust in the EU," he said.

Source: bbc.com

- Read more

-

13/Jul/2016

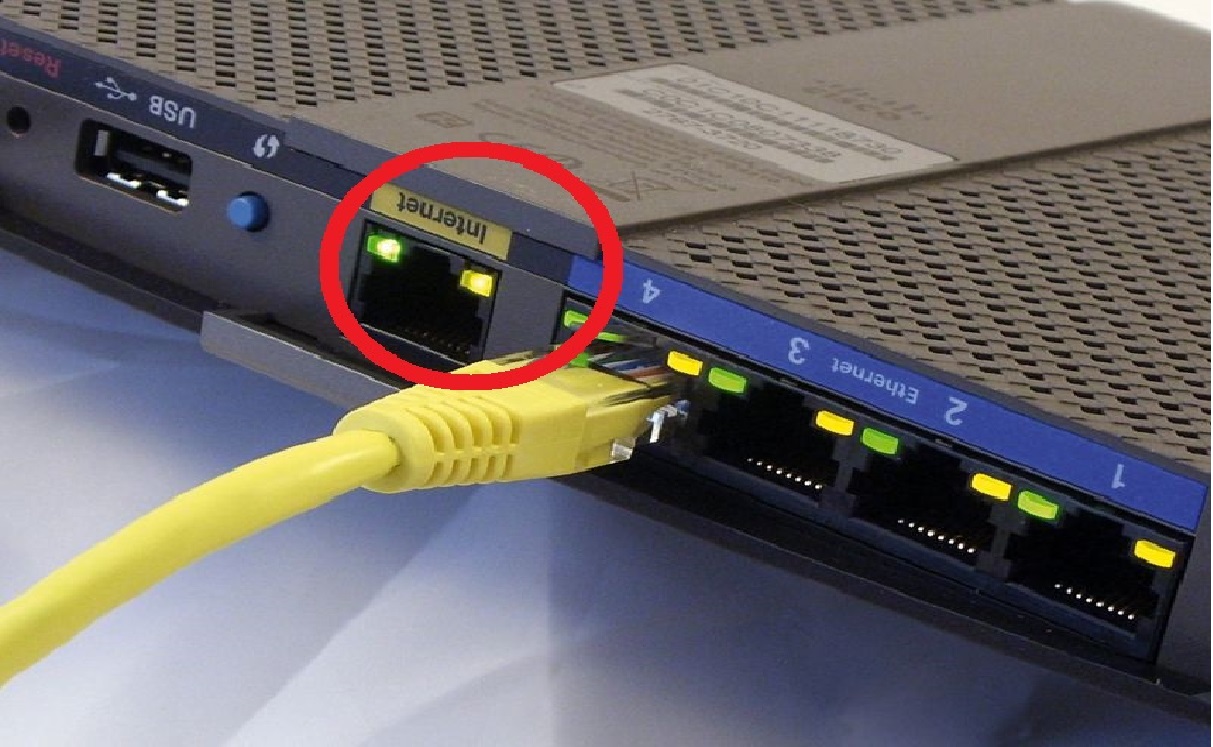

1 Reason Not To Go Online If You Live In The US

If you live in the US and have a computer, tablet or smartphone connected to the internet, then this may be the most important news you read all year.

Earlier this month we saw thousands of people across the US get their hands on the latest Online ID protection from SaferWeb, after yet another increase in identity theft and web-history monitoring.

We have however been advised that because of its unexpected popularity, availability is very limited and is now on a first come first serve basis.

Experts Are Now Calling SaferWeb, “A Game Changer For Internet Users”

As part of the special promotion due to end June 19, 2016, a group of Engineers teamed up with innovative new software provider SaferWeb, to provide the latest ID Protection thats just gone viral.

If you have a desktop, laptop, tablet or smartphone connected to the internet, your activities could be monitored and private information collected when you’re Internet shopping or banking. Even just browsing online is a risk in 2016.

SaferWeb had a primary objective to eliminate this by boosting security and ensure eavesdroppers cannot make sense of your encrypted communications.

Technical Lead John McBride, from SaferWeb explains; Our main objective for creating the app was pretty simple. We wanted to help users protect their Identity & Internet Connection to eliminate the risk of any online, banking or personal information being stolen, monitored or hacked”

The company SaferWeb seemed to deliver on this objective perfectly. Using their technology will give a private tunnel between you and the internet that’s invisible to hackers or any malware, letting you browse the Internet anonymously and securely. Literally anyone can use it and it only takes 5 minutes to set up.

So how can SaferWeb give this away? Apparently this promotional tactic is common among big companies with large marketing budgets. For instance, Burger King launched a similar campaign in 2013, giving away 20,000 free whoppers on Facebook.”

One user we spoke to said, “I came across SaferWeb and decided to give it a go, it’s less than a cup of coffee anyways. I noticed the difference right away and couldn’t be happier with results. I’ve always been anxious about who watches the sites I use and how safe my information really is and heard countless stories about people having their banking information hacked. This is the perfect solution to eliminate this.

So, how do you Protect Your Online Identity Today?

Here is the simple 3 click step recommended by SmarterWebLife to get yourself instant protection:

- Step 1:Click Here to go to SaferWeb, who are market leaders in securing your ID, and internet connection to make it private

- Step 2: Click the “Get a Safer Web” button and enter your name, email and choose a password.

- Step 3:Select a package: I recommend the “Pro” Plan. (Only $5) and Not only will you be fully protected for life, but you’ll also get discounts on thousands of online purchases,by, accessing local currency rates when connecting your computer to the secure connection

- Step 4: Your connection and Online ID are now protected for life One Account for all your devices.. It’s that simple.

SaferWeb Internet Security – Official Website

UPDATE: The promotion is due to end on June 19, 2016 so we urge you to act fast to avoid disappointment.

Source: bbc.com

- Read more

-

18/Jun/2016

Malaysia's Islamic airline Rayani Air barred from flying

Malaysia's first Islamic-compliant airline, Rayani Air, has been barred from flying for breaching regulations.

The Department of Civil Aviation (DCA) said it was revoking the airline's certification because of concerns over its safety audit and administration.

Rayani Air launched last December offering only halal food, no alcohol and crew wearing modest clothing.

It has two Boeing 737-400 planes in its fleet, each able to carry about 180 passengers, eight pilots and 50 crew.

Rayani Air: Five things about Malaysia's Islamic airline

Non-Muslim staff were required to "dress decently" while Muslim female staff wore hijabs

The DCA said on Monday that Rayani Air could no longer operate as a commercial airline.

It follows a three month suspension after the airline failed to follow flight regulations. A safety audit was later conducted to assess its operations.

Malaysia's aviation commission said in a statement that the airline "had breached the conditions of its Air Service Licence (ASL) and lacks the financial and management capacity to continue operating as a commercial airline".

The DCA said it had conducted a "thorough deliberation" on the airline's response to the safety audit.

In the lead up to its suspension, the airline had faced criticism including complaints about cancelled flights as pilots went on strike.

Based on the island of Langkawi, Rayani Air had been flying to the capital, Kuala Lumpur, and the northern city of Kota Bahru.

It had plans to fly to more Malaysian cities and eventually schedule flights to Mecca for the Hajj and Umrah pilgrimages, reports said.

Source: bbc.com

- Read more

-

14/Jun/2016

Gawker files for bankruptcy after losing $140m case

Online news site Gawker has filed for bankruptcy after losing a $140m (£97m) privacy case earlier this year.

The company filed for bankruptcy protection, which could allow it to avoid paying the damages.

In March, Gawker was ordered to pay wrestler Hulk Hogan for invading his privacy by publishing a sex tape.

Gawker told staff it still planned to appeal against the ruling and would continue to operate, but it was now accepting offers to buy the site.

Gawker said it had been forced to put itself up for sale because of "a co-ordinated barrage of lawsuits intended to put the company out of business and deter its writers from offering critical coverage".

Publisher Ziff Davis, owner of PC magazine and Geek.com, has already made an offer to buy all of Gawker's assets, reportedly for less than $100m.

In a statement Gawker's founder Nick Denton said: "We are encouraged by the agreement with Ziff Davis."

The company does, however, plan to consider other offers as it goes through the bankruptcy process.

Last year Mr Denton estimated Gawker Media, which owns the sites Jezebel and Deadspin, was worth between $250m and $300m.

In its official filing Gawker said it had $50m to $100m in assets and between $100m and $500m in liabilities.

Hogan trial

Gawker was sued by Hulk Hogan, whose real is Terry Bollea, after the website published a video from 2007 of Mr Hogan having sex with the wife of a former friend.

During the three-week trial Gawker defended its right to publish the video as part of its celebrity news coverage, while Mr Hogan argued it had been an invasion of his privacy.

The jury ruled in the former wrestler's favour and ordered Gawker to pay $115m in compensation and $25m in punitive damage.

In May a judge denied Gawker's request for a new trial.

In an interview with the BBC earlier this month Mr Denton said he was confident that the original ruling would be overturned.

"I'm confident that when this case comes before judges in a higher court that people will find again there is a place for critical journalism and it deserves to be protected.

"There are substantial protections for the free press in the United States and there's protection for criticism."

'Thicker skin'

In a twist revealed after the trial, Mr Hogan's legal bills were paid by PayPal co-founder and tech billionaire Peter Thiel.

Mr Thiel, said he wanted to curb Gawker's "bullying". In 2007 Mr Thiel clashed with Gawker after the site published an article that outed him as gay.

Mr Denton told the BBC Mr Thiel should accept that his position means he should face public scrutiny.

"If you're a billionaire and you have power and access to the media, you should expect now and then to get the occasional critical piece," said Mr Denton.

"A wiser approach to getting angry and trying to sue a media company out of existence is to ... develop a thicker skin," he added.

Source: bbc.com

- Read more

-

10/Jun/2016

Australia to sell £8m of seized bitcoins

A collection of bitcoins worth about £8m, which had been confiscated by police in Australia, will be auctioned off in June.

The 24,518 bitcoins will be sold mostly in blocks of 2,000 - each with a market value of about £680,000.

Ernst & Young, the firm organising the auction, said the bitcoins had been "confiscated as proceeds of crime" but did not elaborate on the case.

One expert said the authorities had chosen a "safe" time to sell.

Australian newspapers have previously reported that 24,500 bitcoins were seized by police in the state of Victoria in 2013, after a man was arrested for dealing illegal drugs online.

In 2015, Victoria's Asset Confiscation Operations department "confirmed it had recently taken possession of 24,500 coins and would try to make the most of it", according to the Sydney Morning Herald.

'Significant amount'

"This is a significant amount of Bitcoin," Dr Garrick Hileman, economic historian at the Cambridge Centre for Alternative Finance, told the BBC. "It's about a week's worth of new Bitcoin that comes onto the market through mining."

Currently about 4,000 new bitcoins are generated a day, as a reward for "miners" who offer their computer power to process Bitcoin transactions.

The seized coins are auctioned in blocks because quickly selling a large number of coins for cash at a Bitcoin exchange could negatively affect the market.

"Generally the view is that any time 10,000 bitcoins sell, the market price can be moved significantly," said Dr Hileman.

The price of Bitcoin rose to $530 (£362) on Friday, its highest level since August 2014.

Dr Hileman said the Australian authorities had chosen a "safe" time to sell because there is some uncertainty about what will happen to the value of Bitcoin in July.

"The Bitcoin protocol is designed to reduce the number of new bitcoins miners are given as a reward for processing transactions every four years.

"The reward will be halved on 14 July, so prices could go up due to the reduced supply of new bitcoins.

"But there is a question about whether security could decline, if rewards for miners are reduced significantly. So it's a safe time to sell, as there is no guarantee about what might happen in July."

'Set a precedent'

The Australian Bitcoin auction, which will be open to bidders worldwide, is the first such sale outside of the US.

In 2014, the US Marshals Service began auctioning a collection of about 175,000 bitcoins that had been confiscated from the founder of internet marketplace Silk Road.

The final auction of those bitcoins attracted 11 bidders, possibly due to the high cost of each block on sale.

Dr Hileman said the sale of Bitcoin by the Australian authorities was an acknowledgement that the cryptocurrency was not illegal.

"Any time a government sells Bitcoin, it is acknowledging that this is a different asset to drugs, for example, that would not be sold in an auction," he told the BBC.

"That was one of the big takeaways from the US Marshal Service auction - they set a precedent that Bitcoin was not illegal.

"Australia has been going through its own regulatory process - and this makes a standing that Bitcoin is legal to use in Australia."

Source: bbc.com

- Read more

-

30/May/2016

US consumer prices rise at fastest pace in three years

US consumer prices rose at their fastest pace in three years in April as energy prices climbed, figures show.

The Labor Department's Consumer Price Index rose 0.4% last month, the biggest one-month increase since February 2013.

A steady build-up in inflation could increase the likelihood that the Federal Reserve will raise interest rates later this year.

Other data shows housing starts rose by more than expected last month, suggesting an economy gaining strength.

Commerce Department figures showed housing starts rose by 6.6% in April to a seasonally adjusted annual pace of 1.17 million units.

'Picking up steam'

The Labor Department's inflation figures showed energy prices increased by 3.4% in April, the biggest rise in three years, mainly due to an 8.1% increase in petrol prices.

The annual pace of CPI inflation rose to 1.1% last month from 0.9% in March.

"We have the CPI which came in more than expected and that's going to put us again on Fed watch," said Peter Cardillo, chief market economist at First Standard Financial in New York.

"We also had the housing starts come in stronger than expected, so that's another indication that the economy is picking up steam."

Investors are keenly assessing data to try to predict when the Fed will actually raise interest rates.

In December 2015, the US Federal Reserve raised interest rates by 0.25 percentage points - its first increase since 2006.

At the time the Fed said it would continue to monitor a number of factors, including inflation and economic performance, to determine if and when further rises were justified.

Some Fed officials have so far suggested two increases this year, but traders are pricing in only one rise at the end of the year. The Fed's next meeting is in June.

Meanwhile, US industrial production in April rose 0.7%, its biggest increase since November 2014, as utility output surged.

That gain in factory output also supports the view that the economy is making progress.

Source: bbc.com

- Read more

-

17/May/2016

Chobani yogurt boss gives 10% of his shares to workers

Staff at US yoghurt maker Chobani will receive a share of a 10% stake in the yoghurt maker, the company's founder has announced.

While shares are commonly granted to staff in start-up technology firms, it is an unusual move for a food company.

The shares will be distributed among Chobani's 2,000 employees worldwide. The award will be based on how long an employee has been at the firm.

For some the shares could, reportedly, be worth millions of dollars.

Staff will not know how exactly much their shares are worth until the company is given a value, which would happen if it is sold, or sells shares on the stock market.

Chobani would not comment on whether it is considering either of those options.

However, the company is estimated to have a value of several billion dollars.

'Not a gift'

Hamdi Ulukaya, who founded the company in 2005, made the announcement at Chobani's plant in upstate New York.

"This isn't a gift. It's a mutual promise to work together with a shared purpose and responsibility. To continue to create something special and of lasting value," he told staff.

Investment firm TPG Capital is due to buy a 20% stake in Chobani and has loaned it $750m.

The arrangement with TPG Capital was reached in 2014 as part of a deal to prevent the company from falling into bankruptcy.

TPG's stake will be allocated after employees are given their 10% share of the company.

Source: bbc.com

- Read more

-

26/Apr/2016

Apple revenue falls for first time since 2003

Apple reported a 13% drop in its second quarter revenue on Tuesday as sales of iPhones slipped.

The technology giant reported quarterly sales of $50.56bn (£34.39bn) down from $58bn last year - the first fall in sales for the company since 2003.

Apple sold 51.2 million iPhones during the quarter, down from 61.2 million in the same quarter of 2015.

China was a particular weak spot - sales there fell 26%. Results were also hit by the impact of a stronger dollar.

Apple's chief executive Tim Cook said the company performed well "in the face of strong macroeconomic headwinds".

Apple's quarterly profit slipped to $10.5bn from $13.5bn.

Apple also announced it would return $50bn to shareholders through an increase in share buybacks and a 10% increase in quarterly dividends.

Investors had been expecting a slowdown in sales and were hoping for an increase in dividend payments.

Apple shares fell 8% in after hours trading. Its shares have fallen close to 20% over the last twelve months.

Apple should pay more tax, says co-founder Wozniak

China shuts Apple's film and book services

Ford: 'We assume Apple is working on a car'

Sales slowdown

Back in January the company warned that it was experiencing its slowest-ever increase in orders for iPhones and that this would cut into second quarter earnings.

Declining growth in smartphone sales has impacted the entire industry and companies are struggling to find the next area of innovation.

"The industry is in a lull between the mobile boom and what comes next in automotive, the connected home, health and industrial applications of the internet of things," said Geoff Blaber, from CCS Insight.

One bright spot for Apple was its services unit, which includes App Store downloads, Apple Pay and Apple Music. The division experienced a 20% growth compared with the same quarter in 2015.

However, growth at that unit could be threatened by a new law in China passed in March. It requires all content shown to Chinese people to be stored on servers based on the Chinese mainland.

As a result Apple's iBooks and iTunes movies service were shut down in the country.

Apple said it hoped access to the services would be restored soon.

Apple vs. FBI

Apple was recently in a standoff with the US government over whether the company should help the FBI unlock an iPhone.

The FBI wanted Apple to build a program to unlock the iPhone of San Bernardino shooter Syed Rizwan Farook.

Apple refused, calling the government's order a violation of its rights. The FBI eventually turned to outside hackers to break into the phone.

Source: bbc.com

- Read more

-

26/Apr/2016

Support private sector to enhance agric - Kufuor

Former President John Agyekum Kufuor says the only way agricultural productivity can be increased on the African continent is for governments to support its private sector through adequate budget allocations and incentives.

According to him, agricultural production is largely vested in the private sector and supporting it would help contribute to the growth and development of the continent.

Former President Kufuor was speaking at a conference organized by the Comprehensive Africa Agriculture Development Programme (CAADP) in Accra on Tuesday, April 12.

The conference, which was attended by representatives from around the African continent and elsewhere, gave participants the platform to develop ideas and policies to ensure food security around the world.

Addressing participants at the conference, the former Ghana leader said African leaders must formulate acceptable standards that would help supervise the operations of the agricultural sector.

The move, according to him, would enable the sector enter the international market and rub shoulders with its competitors.

Furthermore, he called on the ministries of agriculture to sensitize and educate local farmers on modern systems in agriculture to help enhance the quality of their produce.

Speaking more on measures to increase agricultural productivity on the continent, he urged African leaders to develop measures to clamp down on the incidences of aflatoxins and its related poisons in agricultural production.

He indicated that aflatoxins are a major contributory factor to some severe sicknesses and deaths on the African continent.

Aflatoxins are poisonous and cancer-causing chemicals that are produced by certain molds which grow in the soil, decaying vegetation, hay and grains.

They are regularly found in improperly stored staple commodities such as cassava, corn, cotton seed, peanuts, rice, and a variety of spices.

Source: TV3 Network

- Read more

-

12/Apr/2016

Oil price rises boost Asian markets

Markets in Japan and Australia have started higher on Wednesday, following the gains from US markets.

At the open, Japan's benchmark Nikkei 225 index was up 213.92 points, or 1.3%, at 16,142.71.

In Australia, the S&P ASX 200 kicked off the Wednesday session with a gain of 1.05% - or 52 points - to 5,028.

Among those stocks with the more marked movement, shares of Shinsei Bank in Japan jumped by more than 5% in Tokyo trade.

That followed reports the company will develop a smartphone payment system with a Chinese partner.

Also in Japan, Fast Retailing shares opened 2.2% higher on reports in local media the company will slash prices at its Uniqlo clothing stores. The retailer last week warned that its profit will weaken, due to slower sales.

Elsewhere in Asia, markets in South Korea are shut for a public holiday. Trading will resume on Thursday.

US markets all closed higher overnight, as market sentiment got a boost from higher oil prices. That led to a rally in energy sector shares on Wall Street.

After weeks of decline due to oversupply, oil prices rebounded overnight, on reports oil producers Russia and Saudi Arabia have reached a consensus about a freeze in output ahead of the Opec producer's meeting in Doha, Qatar on April 17.

Source: bbc.com

- Read more

-

12/Apr/2016

Tesla Model 3 pitched as an 'affordable' electric car

Tesla has unveiled its much-anticipated Model 3 electric car - its lowest-cost vehicle to date.

The company's chief executive Elon Musk said the five-seater would start at $35,000 (£24,423) and have a range of at least 215 miles (346km) per charge.

He added that his goal was to produce about 500,000 vehicles a year once production got up to full speed.

The California-based company needs the vehicle to prove popular if it is to stay in business.

The first deliveries of the vehicle are scheduled to start in late 2017, and it can be ordered in advance in dozens of countries, including the UK, Ireland, Brazil, India, China and New Zealand.

Tesla delivered 50,580 vehicles last year. Most of those were its Model S saloon, which overtook Nissan's Leaf to become the world's best selling pure-electric vehicle.

But the firm still posted a net loss of $889m (£620m) for 2015, partly because it spent $718m on research and development over the period.

It left Tesla with cash reserves of $1.2bn, down from $1.9bn a year earlier.

"For a long time there had been questions about the long term viability of Tesla," commented Jessica Caldwell, an industry analyst at the car research site Edmunds.

"With niche products like the Model S and the Model X, it hasn't been hitting any sales targets that would sustain its business.

"So, launching what it hopes will be high-volume vehicle is going to show if it can become a fully-fledged auto company that will succeed in the long-term rather than one that pumps out a few cool cars and then goes bust, as we've seen happen with other electric car start-ups such as Fisker."

'Roomy car'

Other details provided about the Model 3 included:

- The base model will accelerate from zero to 60mph (97km/h) in less than six seconds, other models will go faster

- It will include the "autopilot" safety features found in existing models, which allow the cars to steer themselves and avoid collisions

- It will support "supercharging" as standard, allowing the cars to recharge more quickly at special power stations. Tesla aims to double the number of places offering supercharging to about 7,200 worldwide by the end of 2017

- It provides storage room at the front and rear of the vehicle

Mr Musk added that the car should feel more spacious to passengers than similar-sized petrol-based cars because of design decisions Tesla could make by not using a combustion engine.

"You are sitting a little further forward," he explained. "That's what gives you the legroom to have five adults."

"And the rear roof area is actually one continuous pane of glass.

"The reason that that's great is because it gives you an amazing feeling of openness. So, it has by far the best roominess of any car of this size."

Pre-order excitement

In scenes more commonly associated with smartphone launches than those of vehicles, hundreds of people queued outside Tesla stores in the US to try to secure one of the first Model 3s.

They had to pay a $1,000 deposit to reserve the car before they had even seen it. The company also began taking online orders an hour before its press event had begun.

At the end of his presentation, Mr Musk said that Tesla had already received more than 115,000 orders.

Part of the incentive to commit early is that a $7,500 tax credit offered to US buyers is set to be pulled once the company has sold 200,000 vehicles in the country.

"If you look at the US auto market, the average purchase price is about $33,000, which is close to what the target for the Model 3 is," said Ms Caldwell.

"So, it becomes less of that pie-in-the-sky dream car and something that the average person can actually afford.

"That's why people are excited about it in non-traditional Tesla markets - places outside of San Francisco Bay and Los Angeles - and why we saw lines in places like Houston and Arizona."

Source: bbc.com

- Read more

-

01/Apr/2016

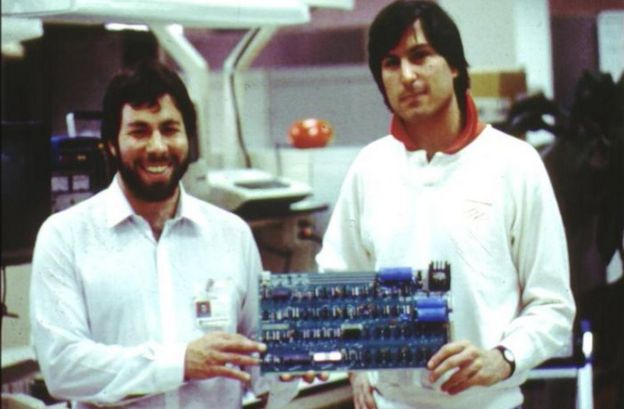

Apple at 40: The forgotten founder who gave it all away

Apple has just turned 40 years old - a timely reason to track down a man who helped start the firm and then walked away.

Drive out of Las Vegas for an hour into the Nevada desert. When you reach what feels like the end of civilization, carry on. That's where you'll find Pahrump.

And it's in Pahrump where you'll find the co-founder of the most valuable, perhaps most powerful company, on Earth.

Ronald G Wayne is 81. When he was 41, he worked at Atari. And it was there he met a young, impressionable Steve Jobs who would regularly turn to Wayne for all manner of advice.

Jobs asked if he should start a business making slot machines. Wayne said no.

Jobs asked if he should go to India to find himself. Wayne said, if you must. Just be careful.

One day, Jobs finally asked the question that changed history: "Could you help me talk some sense into Steve Wozniak?"

"Bring him over to the house," Wayne said. "We'll sit down, and we'll chat."

The two Steves - Wozniak and Jobs - are better remembered as Apple's co-founders

Parental Woz

The charismatic, lovable Wozniak - you can call him Woz - had been working with Jobs on breaking down business computers and making them into something more personal.

The pair frequented the now infamous Homebrew Computer Club, a gathering of enthusiasts who would pick apart circuitry and build it up again in new ways with the same gusto as an imaginative six-year-old faced with a box of Lego.

Woz was the best. A circuit board he built would form the basis of the Apple 1, the company's first computer - and one that sold at an auction in 2015 for $365,000 (£254,300).

Jobs wanted Woz's brain to be an Apple exclusive. Woz was having none of it.

And so it was to Wayne's flat, in Mountain View, California, to thrash out the details.

"Jobs thought that I was somewhat more diplomatic than he was," Wayne recalls.

"He very anxious to proceed with Steve Wozniak to get this into production. But Wozniak, being the whimsical character that he was, everything he did was for the pure fun of it. Woz had no concept of business, or the rules of the game."

Over the course of around 45 minutes, Wayne turned things around.

"He bought into it. He understood," he says.

"It was at that moment Steve Jobs said: 'We're going to start a company. It will be the Apple Computer Company.'"

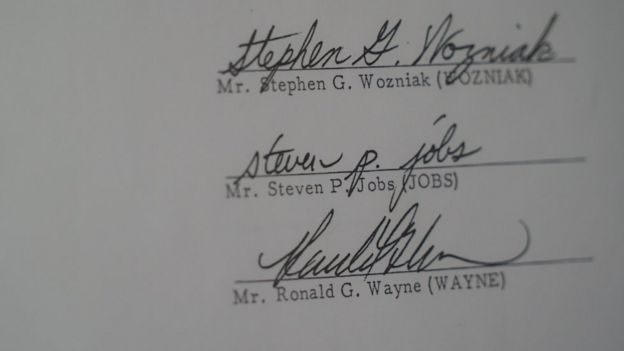

Wayne typed up the documents there and then, on an IBM typewriter, much to the amusement of Woz, who couldn't quite believe Wayne's talent for reeling off four pages of legalese from memory.

Slicing up the Apple pie was straight-forward: Jobs and Wozniak got 45% each, and Wayne had 10%, and a remit to be the voice of reason in any disputes.

Two nickels

Twelve days later Wayne removed himself from the contract.

"For very excellent reasons that are still sound to me today," he said, 40 years and a market cap of $600bn later.

Jobs, ever the skilful salesman, had just secured Apple's first big deal. A small computer chain, the Byte Shop, wanted 50 machines. To get the cash, Apple had to borrow $15,000.

But Wayne had heard - from what source he doesn't remember - that the Byte Shop didn't have a particularly good reputation for paying its bills.

"If the company goes poof, we are individually liable for the debts," Wayne explained.

"Jobs and Wozniak didn't have two nickels to rub together. I had a house, and a bank account, and a car… I was reachable!"

Wayne told the Steves that he wanted to help out where he could, but that he no longer could officially be part of the company.

One lasting contribution was to draw the company's first logo - an ink-drawing of Newton sitting under a tree, an apple waiting over his head. Wayne signed the image, but Jobs spotted it.

"Take that out!" Wayne recalls him saying. He obliged.

Months after severing formal ties with Apple, Wayne received a letter.

"The letter says all you gotta do is sign away every possible interest you could have in the Apple Computer Company, and the cheque is yours," he says.

In return he was given $1,500.

"As far as I was concerned, it was 'found money'. So I went ahead and I signed."

Modest

Pahrump is 500 miles (800km) and one whole universe away from Cupertino, where Apple is headquartered today.

Wayne's home is as modest as it is loved. Ornaments from the life of a curious engineer and collector are dotted throughout.

By the door, an old silver slot machine. Against one wall, a still-functioning radio from the thirties, housed in beautiful mahogany.

Mr Wayne's home is a far cry from the luxury estates of Silicon Valley's billionaires

He told me about the time he made a scale replica, both interior and exterior, of the Nautilus - the colossal submarine featured in the film 22,000 Leagues Under the Sea. He didn't have any blueprint to work with, instead studying freeze-frames from the film.

When he was finished, he gave it away to a museum.

Today, a 10% share of Apple would be worth almost $60bn. If Wayne regrets his decision, he's extremely good at covering it up.

"I would've wound up heading a very large documentation department at the back of the building, shuffling papers for the next 20 years of my life. That was not the future that I saw for myself.

"If money was the only thing that I wanted, there are many ways I could've done that. But it was much more important to do what appealed to me.

"My advice to young people is always this - find something you enjoy doing so much that you'd be willing to do it for nothing… and you'll never work a day in your life."

Long-lost brother

Wayne keeps all his fan mail in a small box in the corner of his study. It's full of autograph requests, calls for advice and general messages of admiration.

One letter, from a fan called Jason, jokes about the notion of the infamously self-assured and combative Steve Jobs ever being able to take the constructive criticism Wayne was able to dish out.

"He was a fascinating man," Wayne reflects.

"Who made Apple what it is? Obviously, Jobs.

"Was Jobs a nice guy? In many ways, no. But that doesn't matter."

Wayne considered himself the "adult supervision" to the Jobs dream, even offering a supportive boost early on.

"Jobs says: 'You know, I'm having second thoughts about this. There are other things I want to do'.

Mr Wayne sold his copy of the original Apple contract, but kept a replica

"I said: 'Steve, whatever it is that you want to do, you can do it a lot more easily with money in your pocket. Go ahead and make the money, and do whatever you want to do. Just don't forget what you wanted the money for'.

"He forgot. I think he became so involved in the mechanics of running Apple that it was more like he was caught up to such an extent that nothing else mattered."

Apple-free life

While having no remorse about giving up his role in Apple, Wayne does have at least one regret: selling his copy of the original signed contract, for $500.

In 2011, that same document fetched $1.6m at auction. Just one more "what if" to add to the list.

Looking around Wayne's home, there's no Apple products to be seen. He prefers to build and customise his own technology - it's more fun that way, he said.

In 2011, someone gave him an iPad 2 as a gift. Like so much else in his life, Wayne gave it away.

Source: bbc.com

- Read more

-

01/Apr/2016

Batman v Superman takes $424m at global box office

Batman v Superman: Dawn of Justice has taken $424m (£300m) at the box office worldwide in its first five days despite poor reviews.

The global total - the fourth-highest ever - included $170.1m in the United States, a record for a March debut and the sixth-highest US opening weekend.

Dawn of Justice took £15.5m in the UK - also a record for March.

The film bringing the two superheroes together for the first time is a welcome success for Warner Bros.

The studio has been hit by a series of expensive failures such as Jupiter Ascending and Pan in recent months.

The DC Comics adaptation, which cost more than $250m to make, was Warner Bros' second-highest international opening after Harry Potter and the Deathly Hallows: Part 2.

The BBC's Mark Kermode described it as a "crushing disappointment", while Kate Muir wrote in The Times: "This superhero-smorgasbord melts into an electric soup of CGI."

Jeff Goldstein, head of distribution for Warner Bros, said: "There was a disconnect there between what critics wrote and the fan interest and the fan response."

The film had been widely praised by fans after its first screening in New York in mid-March, but received less glowing reviews from critics.

Paul Dergarabedian, senior media analyst for comScore, said: "It proves that the concept is bigger than negative reviews. There was no way that if you're a comic book fan or just a movie fan that you're going to miss out on a match-up of such iconic characters. Audiences have to see the movie for themselves.''

Dawn of Justice opened on more than 40,000 screens in 66 markets, including 16,000 in China, 4,242 in the US, 1,701 in the UK and 1,696 in South Korea.

"It's the fans that speak the loudest," said Jeff Bock, a box office analyst for Exhibitor Relations. "It proves how strong these characters are."

The Zack Snyder-directed film, starring Ben Affleck and Henry Cavil, is the first of 10 DC Comics adaptations planned by Warner Bros over the next five years, including Wonder Woman and the Flash.

The first, Suicide Squad, will hit the big screen in August.

Star Wars: The Force Awakens still holds the record for the biggest box office debut weekend globally, with ticket sales of $529m (£355m) in December, including $248m in the US.

Last weekend's top film, the animal animation Zootopia - known in the UK as Zootropolis - was pushed into second place by Batman v Superman, taking $23.1m (£16.3m) in the US.

My Big Fat Greek Wedding 2, starring and written by Nia Vardalos, who was behind the first, hugely successful film, came in third place with a respectable $18.1m (£12.7m).

But teen sci-fi film The Divergent Series: Allegiant fell 67% in its second weekend with just $9.5m (£6.7m), tying with faith-based drama Miracles from Heaven.

Drone thriller Eye in the Sky, whose cast includes Helen Mirren and the late Alan Rickman, took $1m (£705,000) in its third week, while Hank Williams drama I Saw the Light, starring Tom Hiddleston, took $50,464 (£35,599) on just five screens.

Source: bbc.com

- Read more

-

28/Mar/2016

Valeant boss ordered to testify on drug pricing

The chief executive of Valeant Pharmaceuticals has been ordered to give evidence about rising drug prices to a Senate committee.

Michael Pearson was ordered to appear on 27 April to testify about the practice of buying the rights to old medicines and raising prices.

Valeant is facing three separate federal investigations into its business practices.

Shares fell more than 7% on Monday in New York following the announcement.

The Senate Aging Committee sent letters to the heads of several other drug makers asking them to testify as well.

In November, Senator Claire McCaskill, who is leading the investigation, said she was concerned that the practice was "price-gouging".

"Some of the recent actions we've seen in the pharmaceutical industry - with corporate acquisitions followed by dramatic increases in the prices of preexisting drugs - have looked like little more than price gouging," she said.

Valeant is not alone in the practice of buying existing drugs and raising the prices. Its focus on acquisitions rather than development of new drugs, however, has raised questions about the Canadian company's long-term viability.

John Hempton of Bronte Capital, who is betting against the stock, told the BBC: "Saying Valeant's problems are from its business model is against the point because other pharma companies are still working on that model. But raising prices so fast was never going to be acceptable in the long run."

The company's New York-listed shares have plunged more than 70% this year.

Last week, Valeant announced that Mr Pearson would step down as chief executive as soon as a replacement could be found.

Activist investor Bill Ackman, one of Valeant's largest shareholders and most outspoken supporters, has joined the company's board.

Source: bbc.com

- Read more

-

28/Mar/2016

US economic growth revised upward

The US economy grew at an annualised rate of 1.4% in the fourth quarter of 2015, according to official figures.

The US Commerce Department revised its fourth quarter GDP to upward from an initial estimate of 0.7%.

Overall, the US economy is estimated to have grown at a rate of 2.4% for all of 2015.

One reason for the revised figure was greater consumer spending than officials initially thought, boosted by an improving labour market.

Analysts had expected the fourth quarter growth rate to remain unchanged from the last estimate of 1%.

"It's especially good that we saw a boost in consumption, however we are only talking about 1.4% growth, which is still anaemic compared to the 3.5% we would like to see," said Dan North, chief economist at Euler Hermes North America.

"The economy is still running in low gear," he said.

Increased employment has helped to slowly boost wages and housing prices, while low oil prices have increased discretionary spending by US households.

The stronger growth rate could increase the chances of an interest rate hike when the Federal Reserve meets in April. The central bank left rates unchanged at its meeting in March, saying the slowing global economy raised risks for the US market.

US corporate profits dipped 11.5% for the fourth quarter compared to the same October through December period in the previous year.

Companies were hurt by low oil prices, with some industrial and petroleum linked companies forced to cut their workforces or file for bankruptcy.

Source: bbc.com

- Read more

-

25/Mar/2016

About Us

-

Archives

Recent posts

News for people who want to know

- Bakus Radio resource for |Ghana & Africa music |News |Entertainment |Sports | Copyright © 2016 . All Rights Reserved.

- Designed By Fresco Software Solution Pvt. Ltd.